does wyoming charge sales tax on labor

A state-by-state analysis of charging sales tax on services. To learn more see a full list of taxable and tax-exempt items in Wyoming.

Sources Of Personal Income In The Us 2021 Tax Foundation

For additional information on these sales and services see Publication 201 Wisconsin Sales and Use Tax Information.

. What is included in Wyomings sales tax basis. Wyoming Sales Tax Rates. The state sales tax rate in Wyoming is 4 and there are some places in the state where that is the only rate that applies.

In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The wholesaler shall be entitled to retain four percent 4 of any tax collected under WS. County Sales Tax Rates.

Labor unions and workers organizations are exempt from taxation on dues and other forms of income. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. A yearly fee when you file your annual report.

This page discusses various sales tax exemptions in Wyoming. Services are subject to sales tax in a number of states. According to the federal Bureau of Labor.

Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7. This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not. State wide sales tax is 4.

Currently combined sales tax rates in Wyoming range from 4 to 6 depending. When state legislatures in the United States implemented the first sales tax laws to boost revenues in the 1930s the American economy depended on the manufacture and sale of physical goods. Skip to main content.

See the publications section for more information. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

Use Tax By State. Are services subject to sales tax in Wyoming. Transportation or delivery charges paid by the Wisconsin purchaser to a carrier which is independent of the seller.

Wyoming Permits and Licenses. Various fees for renewing your licenses and permits on a regular basis. If you do not file your sales tax return within 30 days of the due date of your return you will also be charge an additional 2500.

If I buy cigars from a company in Colorado who is not a wholesaler in Wyoming as a Wyoming vendor am I responsible for the 20 excise tax. Wyoming is the cheapest state to buy a beer in the state excise tax on beer is only 002 per gallon. Covered under 501c4 and 501c5 of the IRC.

One question that will often arise is whether or not a certain payment or fee is included in a transactions. Wyoming sales tax reference for quick access to due dates contact info and other tax details. Sales Tax By State.

Wyoming Department of Revenue. In addition to the Wyoming corporate income tax Wyoming corporations must also. Wyomings sales tax is the 44th lowest in the nation and its tax on beer is the 50th unchanged since 1935 when it was set at 002 a gallon.

While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. Learn about standard filing costs here. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

You can learn about those times here. Wyoming Use Tax and You. Typically early sales tax laws allowed only the taxation of tangible personal property.

Fees for forming a corporation in Wyoming. Wyoming State Annual Report Fee. Excise Taxes By State.

Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee. Sales and Use Tax. No you do not pay sales tax on labor.

Unlike Wyoming which charges its highest property taxes on the mineral industry Montana does not levy a property tax on oil gas or coal holdings. Pennsylvania for example charges tax on numerous services including but not limited to lobbying services secretarial or editing services and building maintenance or cleaning services. The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services.

Wyoming Internet Filing System WYIFS The following are from this page. An example of taxed services would be one which sells repairs alters or improves tangible physical property. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

Groceries and prescription drugs are exempt from the Wyoming sales tax. You can look up the local sales tax rate with TaxJars Sales Tax Calculator. Many times an otherwise-taxable transaction will include bundled fees like excise taxes installation fees or finance charges or be modified with coupons installment payment plans etc.

Does minnesota charge sales tax on labor. The sales price of direct mail does not include separately stated delivery charges. The Excise Division is comprised of two functional sections.

Counties are able to add their own local sales tax to this state rate however and this can come in the form of an economic development county option tax a general purpose county option tax or a. This page describes the taxability of services in Wyoming including janitorial services and transportation services. The state sales tax rate in Wyoming is 4.

These depend on the type of business you. Sales Tax Exemptions in Wyoming. Herschler Building 2nd Floor West.

In Wyoming when a tool is lost down a hole or damaged beyond repair during the pre-production casing phase of an oil or gas well the charge for the tool will not be subject to sales tax. There are several exemptions to the state sales. Wyoming sales tax reference for quick access to due dates contact info and other tax details.

Challenges Opportunities Of The Current Labor Shortage

Virginia Labor Law Poster 2021 Replacement Service Va Labor Law Posters

Free 2022 Illinois Labor Law Posters Labor Law Center

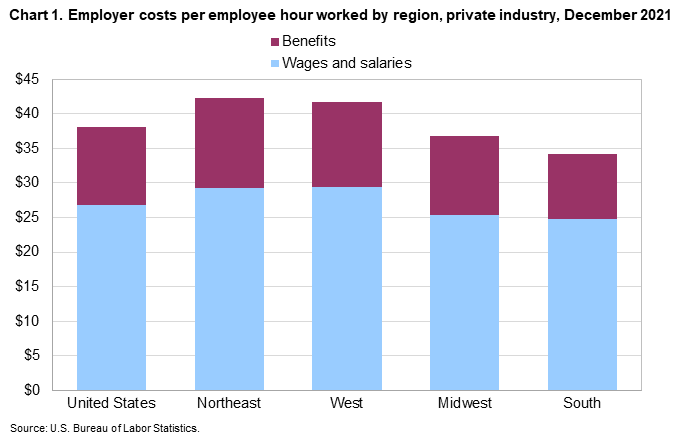

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

Ohio Labor Law Poster Poster Compliance Center

Youth Unemployment A Scourge Of The Covid 19 Economy Reuters

The Labor Market During The Great Depression And The Current Recession Everycrsreport Com

Living Wage Annual Expenses To Support A Family By Us State Map Supportive States

Average Labor Cost Statistics 2022 Facts About Cost Of Labor In The U S Zippia

Wyoming Sales Tax Small Business Guide Truic

Commercial Construction Cost Per Square Foot In The U S Bigrentz

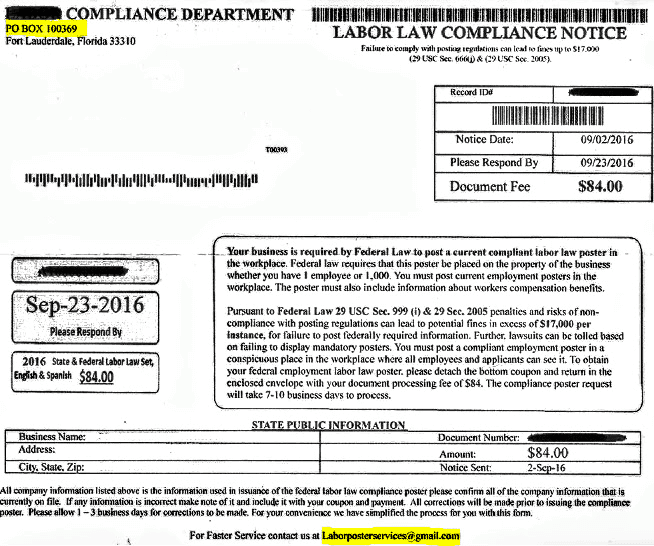

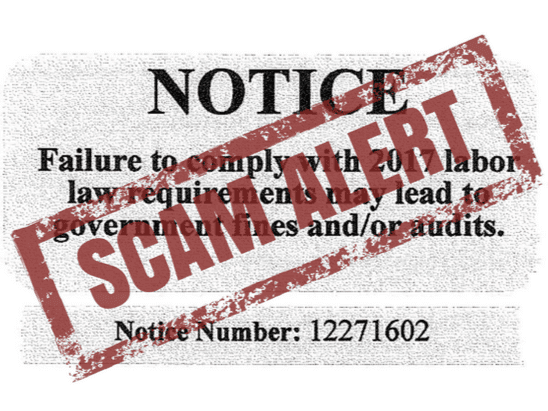

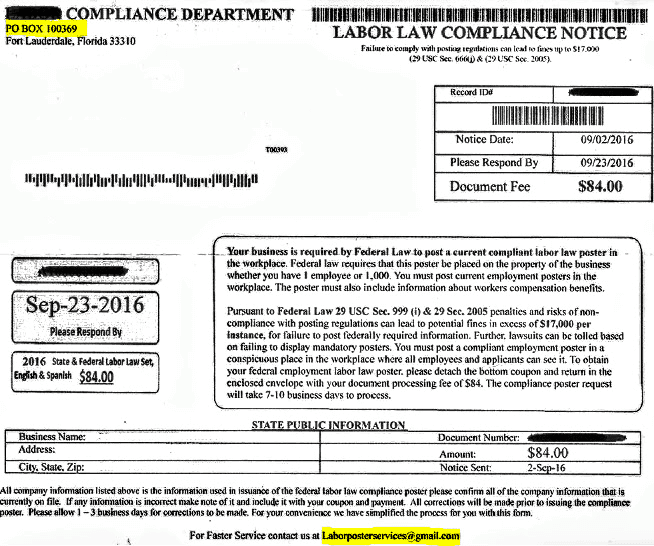

4 Signs Of A Labor Law Compliance Scam

How To Form An Llc In Wyoming Llc Filing Wy Swyft Filings

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

4 Signs Of A Labor Law Compliance Scam

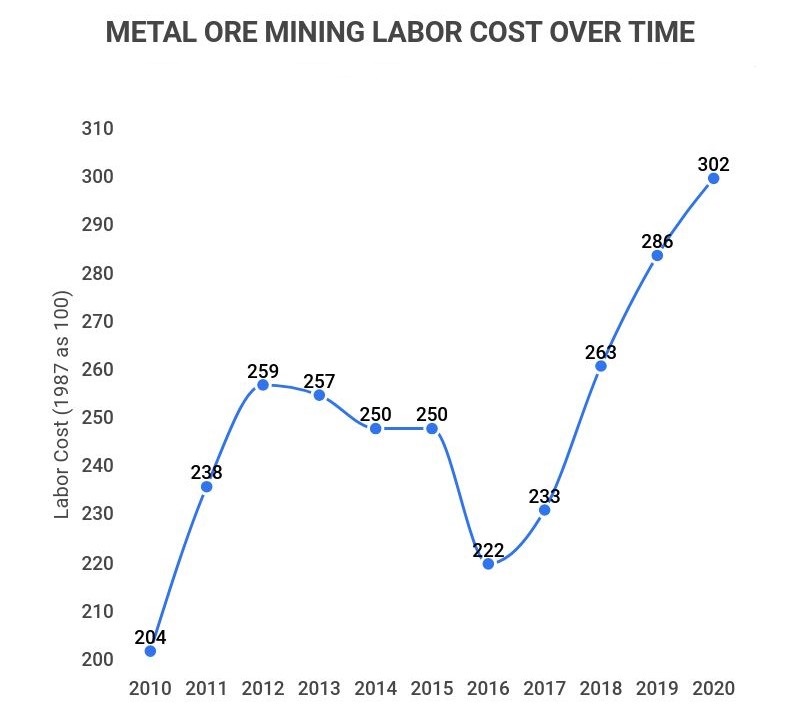

Average Labor Cost Statistics 2022 Facts About Cost Of Labor In The U S Zippia